I may take risk in chess, but it is completely unacceptable in finance - Vishy Anand

A very interesting article has been published earlier this week by the Livemint, an Indian financial daily newspaper. In this article Anand shares with us how managing money is similar to handling chessboard, the key is to study past dealings and apply knowledge to new transactions. It gives you interesting insights into the mind of one of the best chess players and how he thinks about finances. Anand has won five World Championships, done various advertisements and endorsements, has a permanent sponsor in NIIT. Naturally he makes good amount of money and needs to manage it well. Read the full article to learn money managing tips from the Tiger of Madras.

This article was originally published in the Livemint on 10th September.

What’s the similarity between chess and finance? Grandmaster Viswanathan Anand says there is a basic connect in the method of learning chess and finance. “You can relate chess to finance. Quite a lot of chess players have moved on to finance after their chess career,” said Anand. The ability to look at past financial transactions and apply them differently is something conceptually very similar to looking at a previous game of chess and understanding what was done well or badly and applying a same opening in a different way, he explains. Through his life journey, Anand gives us five money lessons:

Seek professional advice

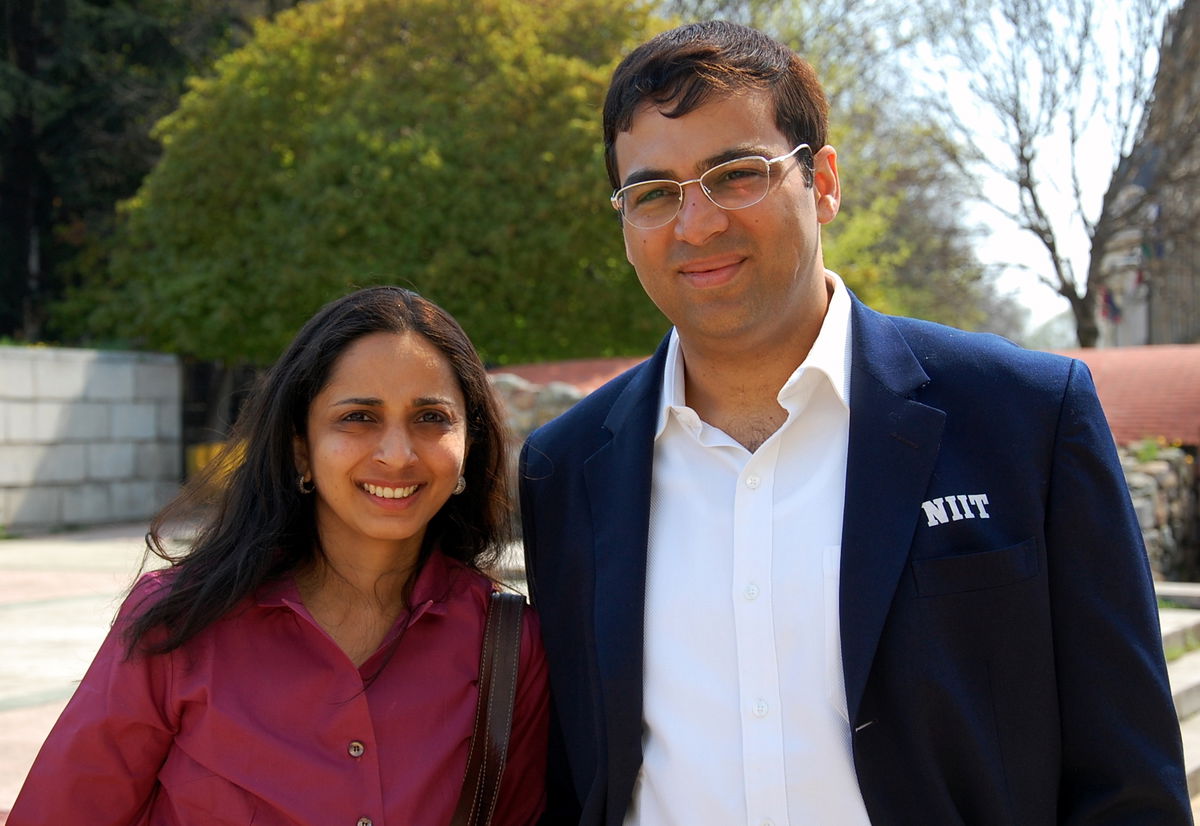

Anand is a world champion in chess and has trainers to guide him. Similarly, he has a professional financial adviser to help him with his finances. “I have advisers to help me. In chess, my trainers help me see what I have missed. Here (in finance), I don’t have the time to follow my investment portfolio on a daily basis. Hence, I have professionals to eliminate rookie mistakes. I follow and grasp their strategy,” said Anand. He says that in chess, you can follow the game without following the details. But to play it, you need to get into the details. Similarly in finance, to manage your money, you need to know the details. Anand’s wife Aruna Anand manages most of the investments with the help of advisers.

Diversify your investments

When you dig deeper into Anand’s investments, you will notice it has a good mix of equity and fixed income. “We have a mixture of products. We do a lot of investment in equity and fixed income instruments. Occasionally, we add alternative products as well. But I do most of my investments through equity, usually with a mix of mutual funds and other kinds of equity instruments. For liquidity, we have some part in cash,” said Anand. He says he doesn’t invest in gold and real estate. “I prefer equity and fixed income,” said Anand.

Take calculated risk

Anand believes in investing in equity for long-term needs. “I have accepted the idea that if you have to beat inflation, you have to be in equity. And if you are in equity, there has to be some risk. I am not against risk. In my investment portfolio, some part of the risk is hedged and some part of the risk is balanced. I am not an all-in kind of a person. I don’t play hunches. I try to understand the risk-reward ratio. If I am comfortable with it, I will do it. I don’t see myself as an aggressive investor. I think of myself as a planner,” said Anand. He is willing to take more risk in chess than in his finances and for a reason.

“I may take risk in chess, but it is completely unacceptable in finance because my skills are completely different. In chess, I am one of the best players in the world. However, I think your personality determines your style in many things,” said Anand.

Goal-based approach

Usually, most people tend to look at highest returns or for the right instruments. Anand says there is no right strategy, but “strategies that you discover are appropriate for you”. In life, you see people who do things radically different from you. “Finance is just an enabling mechanism, as long as it is well thought out and you revisit it occasionally to see if it still makes sense to you. It has to express your personality. Professional help, I felt it was right for me and we benefit from it. Money is not a goal in itself, it is what you want to do in life,” said Anand.

Take responsibility

In many households, one of the spouses is considered in charge of money while the other is a mere spectator. But not in the case of Anand’s household. When it comes to money management, Anand says they both share responsibilities. “She is more disciplined and able to spend the time to understand the money we have, where it is put and the tax implications. She helps me in that area. We have a good division of responsibility as a couple. She takes on quite a lot of the hard work. But that gives me the freedom to dream about chess and immerse myself deeply in it. We discuss the financial instruments together. I understand it conceptually where we are. However, I am not following it on a daily basis,” said Anand. Though his wife deep-dives into the investments, Anand is completely in the know about the strategies they take.

About the author: